The VectorVest Colorguard is Mildly Bullish this morning as Jobless Claims drop to 385,000 and more companies beat earnings estimates. Meanwhile, inflation fears and the Delta variant of COVID continue to keep the market in check and unable to piece together consistent daily gains. The VV sentiment is to buy safe, undervalued stocks currently rising in price.

Stock futures have fluctuated today as investors look ahead to U.S. jobs data and remained concerned that inflation could hamper the economic recovery. That said, here’s where the market stands at 12:15am EST:

| Market Sentiment |

| RoboTrader Portfolio as of 8/05/21 |

Here are my RoboTrader Portfolio holdings as of this morning. To note, all trades were automatically placed on a paper trading account at 12:15PM EST today.

Short-term indicators have turned Mildly Bullish and the auto-trader added 2 positions today, both of which are up!

| Etrade Portfolio Stock Spotlight |

AGFY – develops advanced and precision hardware and software grow solutions for the indoor agriculture marketplace. It offers Agrify Precision Elevated cultivation solution that combines integrated hardware and software offerings with a wide range of associated services, such as consulting, engineering and construction. The Company offers its modern solutions to cultivators across various commercial segments including fruits, vegetables, hemp and cannabis. Its business model includes substantial equipment sales for the Agrify Vertical Farming Unites (AVFUs) as well as recurring software-as-a-service (SaaS) revenues for Agrify Insights.

I purchased this high performer about a month ago and it’s done very well. It’s currently Buy rated within VV and is sporting strong technicals and we’ll see how fundamentals are developing next Thursday as an earnings call is scheduled. Buy at $19.26

| STASH INVESTING – FREE STOCK OPPORTUNITY |

My aunt started using STASH last summer to save, bank and invest. After seeing how it worked I decided to try it out myself. Since then, I’ve seen some amazing investment gains and have grown to love using the STASH Card and earning stock back from purchases.

Up 196% since August 2020

$821 saved by Rounding Up and making auto transfers

Yesterday I earned a small amount of educational stock Chegg (CHGG) to go along with 7 other freebies over the past month. Next Wednesday night at 8PM STASH is giving away more FREE Stock so stay tuned! If you’re not signed with STASH, now might be the best time to take control of your saving and investing. Click here to signup!

PARTY STARTS EVERY WEDNESDAY AT 8PM! GET STASH NOW!

| CRYPTO Corner |

I’ve been using Coinbase for the past 3 years and find it super easy to use for buying, moving and earning Crypto! Wish I had bought much more Bitcoin back then! When you spend $100 both you and I get $10 in Bitcoin. Let’s get it started! Get Started On Coinbase!

| Research Materials |

ARK Investments has provided a detailed investment report for 2021 and beyond. It covers what’s anticipated for the following:

| Must Read! Reddit Profit Taking Article |

| Need Money For Your Business? |

My LLC and Brand Name which covers Digital Marketing & Analytics Consulting

This is a marketing message from Rock Digital, LLC as sent from [email protected]. Please reply to sender with any questions or to opt-out from this newsletter.

Rock Digital LLC © All rights reserved Ph: 877-670-1590 | [email protected] | www.rockcapassoc.com

Image Source: Unsplash Content Credited To: Julia Mitchell

One of the many advantages of starting a business at home is flexibility. However, you can also launch and develop a business part-time or make it your full-time job to create an income source, pay off debt, or fulfill your dreams. Here are a few tips on launching and building a profitable home-based business.

Most entrepreneurs know what kind of company they want to launch before starting it; if you don’t, you can find a product or service to offer if you consider a few things . For instance, if you have worked in a field for many years, you can take advantage of the skills and knowledge you amassed and eventually put them to work for you. However, you can also start anew in an industry you love and make your way up to the top with efficient marketing strategies and a good business plan.

Your company will require a solid business plan to present to any investors when looking for funding. The best place to start would be estimating the basic cost of operations, which will contour and help you gauge how much money you need to produce the item or deliver the service you intend to offer. These expenses include production costs, shipping, taxes, rent for an office or storage space, employees’ wages, etc. Knowing your operational costs will be crucial to determining if your start-up will be profitable since you need to make more than this ground line to stay in business.

Additionally, you want to ensure that you accurately predict business expenses if you’re looking to raise capital for the venture. Standard methods to raise money include angel investors, personal loans, business grants, crowdfunding, etc. Numerous services also offer countless programs; you can find them through a firm like Rock Capital & Associates, which can develop the best financial path for your business and provides counselling and management solutions. Using a specialized service makes things easier for yourself and can develop your company beyond your wildest dreams.

As soon as you come up with your business idea, start identifying your target market. A target market is a specific group or segment of the population that is likely to take an interest in your products or services. You should research and determine your target market to make sure there are sufficient customers available. This is also a great way to find out how your competition operates so you can differentiate yourself from them.

Setting up your business’ web design is a must , as it is an essential form of marketing. Keep it simple, but remember that you have less than five seconds to grab a prospect’s attention. Advertising is crucial as it allows you to create messages that will reach your target market and show them how you are different from your competitors. To have successful marketing campaigns , ensure your customers are aware of your brand and engage with it. Use social media, place ads on different platforms, and share your content to make the best of this tool.

To be successful, you want to invest time into finding gear and technology that feel good to you and help you save money and work. Some key considerations include ergonomics at your working station, accounting software, a records system, etc. From doing taxes to paying your employees, you’re going to want a solid record system to help your company run smoothly and efficiently. Invest in labels, file cabinets, and digital records software to keep your management segment organized and up to speed.

Establishing a payroll system for the first time can be overwhelming, but you can make things easier with software that makes the most sense for your business and is compatible with the system. Today, there are numerous payroll apps on the market, but some allow you to calculate and schedule the payroll automatically. It’s also wise to use software with a tax filing and benefits function, as well as a same-day direct deposit option for your employees, if you want to keep things organized and up to date.

Never mind what business idea you have – you can make it successful from your home and have the flexibility you need. Just ensure that you work out the operational costs, know who your target audience is, advertise your offering to them, and implement a solid system to keep your venture organized and running smoothly.

Rock Capital & Associates has countless business programs available for their clients. Hiring a business finance consultant with the company gives you access to hundreds of funding sources with excellent interest rates and terms. Connect with the team via the Rock Capital & Associates website or by calling (877) 670-1590 today.

Many of my clients who’ve recently applied for the PPP Loan 2nd Draw through my Smartbiz portal have had to upload additional documents. The problem with this process is that after the loan process is completed, there’s no specific space for document uploads.

Given the above, we’ve learned to “step-through” the loan application process in order to submit additional documents and keep the loan process moving forward.

Below are the steps required to add documents to your Smartbiz PPP Loan:

The above has worked in each of the cases my client was required to upload additional documentation. Documents can be uploaded for IRS Forms, Payroll Forms or Miscellaneous Reports like an Income Statement.

If you haven’t yet applied for the PPP Second Draw, start your process now with Smartbiz!

I recently applied for the EIDL loan and was very surprised about how short and quick the application process was. Before I get into my 3 key takeaways, let me give a quick overview of what it is and who qualifies:

The loan is designed for Small Businesses, Sole Proprietor, Independent Contractor and Non-Profits. The applications are administered by the Small Business Administration. Notable qualifications and loan details are as follows:

Now that I’ve covered the basics of qualification, use of funds and the loan details, here are my 3-takeaways from working through the application:

Take your time to think about item #2 as this will directly impact your ability to qualify. Click here for more detail and a sample calculation for a Beauty Salon.

As many may be aware, the second coming of the COVID-19 Stimulus Plan was signed into law on December 27, 2020. It provided for $900 Billion of support including extended unemployment benefits, rent relief and eviction protection as well as funds for small to medium sized businesses hit hard by the pandemic.

RULES FOR SELF EMPLOYED

Self-employed individuals have found the rules around PPP difficult to understand and question whether they qualify, especially since many were either told that during the first draw or were denied as many larger companies received much need working capital.

One thing to know is that the new Stimulus Bill is much more inclusive and is geared more towards the unemployed and Mom and Pop businesses. Here are the qualifications:

What’s important to note is that 1099 employees should not be included in the calculation. The SBA (Small business Association) provides guidance on how to do this. But typically, the qualifying amount is 2.5x Payroll or what’s on Schedule C, Line 31 as the Net Profit. You can view or download the SBA document here.

STEPS TO CALCULATE

Use these steps if you have no W-2 employees in your business:

To note, if you are using 2020 and have not yet filed a 2020 return, fill it out and compute the value annualized up to $100,000 and prorated for the reporting period (if you are filing/using Quarterly 941). The Line 3 amount must be $100,000 or less. If not, reduce it to $100,000 and if less than Zero set to Zero.

You will not qualify for amounts less than Zero. Similar rules and steps are provided in the SBA document for business with employees. You can find that information here starting on page 2.

We have partnered with Smartbiz Loans who’s funded more than $4 Billion in loans since 2013 to make the PPP Loan process quick and efficient. You can prequalify in 5 minutes and complete the entire process in less than an hour if you have documentation (CARES Act Payroll Reports, IRS Form 941, IRS Form 1040 Schedules C or E and Personal documentation).

Or Contact Rock Capital Associates at (877) 640-1590 to start your application.

Now that the $900 Billion COVID-19 Relief Package has approved and signed into Law. I’ve begun to unwrap it’s details beginning with an area that may not be discussed in great detail or as often as PPP or EIDL relief.

What’s new and exciting is that just over 15%, or $15 Billion, of the new program has been earmarked to help live venue operators or promoters, theatrical producers, live performing arts organization operators, museum operators, motion picture theater operators, and talent representatives who demonstrate a 25 percent reduction in revenues. Essentially, if your business utilizes ticket sales to generate receipts, then you may be eligible if you’ve experienced significant loss of revenue.

I’ve attached a very good article that details the following:

• Application Timing

• Eligibility

• How to Calculate Amount

• Grant Money Spending Guidelines

This is my Mom’s recipe for Peach Cobber, my all-time favorite dessert!

When I was younger my mother used to make the best Peach Cobbler. She’s not around any longer to shower me with such great treats, so I had to take matters into my own hands.

Below is my resume for Peach Cobbler from what I remember as I watched my mom cook up this scrumptious, fruit dessert. My take on it is that I like to make it in a bundt pan so there’s plenty to go around. And there’s something about how it presents in that uniquely designed pan.

Prep time

10 mins

Cook time

35 mins

Total time

45 mins

Serves: 8-10

Cobbler Ingredients

Crust and Topping Ingredients

Instructions

I wanted to share an article I contributed to on the #PostFunnel forum managed by #Optimove. The site gathers some of the brightest minds in Performance Marketing and Customer Relationship Management to discuss hot topics and share information and ideas.

In this inaugural Advisory Partner series, we discuss key trends of the “New Normal” and share points-of-view from key partners at Data Culture and Dynamic Yield.

Enjoy the article and check back for our next installment of bright ideas and key topics!

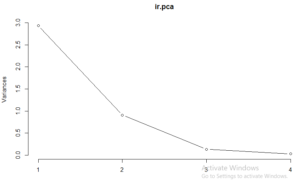

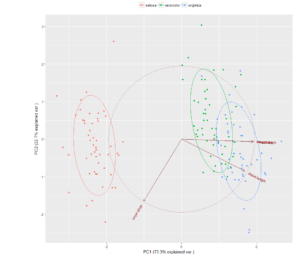

I recently completed a Data Science course and wanted to review Principle Component Analysis (PCA) to develop my skills in understanding data variables highly correlated to the independent variable.

What is Principle Component Analysis (PCA)?

PCA is an ordination statistical method that reduces the dimensionality of multivariate data by creating a few new key explanatory variables called principal components (PCs). It’s mostly used as a tool in exploratory data analysis and for making predictive models.

For now, I’ll use PCA to evaluate the principal components of the Iris dataset. And later on I anticipate utilizing the methodology as part of a process of developing both a churn model and to predict customer lifetime value.

Iris Flower Data Set

The Iris Flower dataset is a multivariate set of 150 observations covering 3 flower species collected from various regions across four features; the width and length of the sepals and petals. It was initially introduced by the British statistician and biologist Ronald Fisher in 1936 and remains a very common practice set for data science (click here for more info). The data quantifies the morphologic variation of Iris flowers of three related species. Two of the three species were collected in the Gaspé Peninsula, all from the same pasture, and picked on the same day and measured at the same time by the same person with the same apparatus.

My analysis for this dataset will be to determine the key explanatory variables using PCA and the taking the following steps in R (click here to see R code):

Analysis

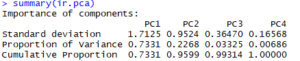

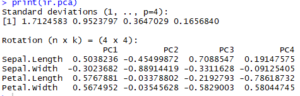

Here are 2 tables of output from running the PCA function in step 4 above:

Table 1 – Summary of Iris PCA Object

Table 2 – PCA Object Standard Deviation and Coefficients

Observations

The Setosa flower is clearly different from the Versicolor and Virginica which could possibly be explained by the pollination process or some other variable.

2017 Rock Digital, LLC Design & Developed by Buy Wordpress Templates