Author: Carleen Moore | [email protected]

If you’ve been dreaming of workplace independence and want to make a difference for the planet, ecopreneurship may be the right path for you. More and more customers are searching for businesses that make a genuine effort to protect the environment. Right now is the perfect time to start a business that builds eco-friendly practices into its very foundation.

However, many hopeful ecopreneurs aren’t sure where to start. Here’s how you can reach your business goals while protecting the planet, presented by Rock Capital & Associates.

Handling Finances

Keeping financial goals on track will give you the foundation you need to make an impact.

Managing Supply Chain

Remember to consider the broad global impact your business makes.

Everyday Environmentalism

Here are some simple things you can do every day to keep your business sustainable.

Your small business can make a bigger impact than you might think. We hope this article inspires you to embrace the ecopreneurship movement. The more new businesses that start with the environment in mind, the brighter the future can be!

Rock Capital & Associates saves you time by having your loan or lease directed to the most appropriate funding source so you can determine the best financial route for your company’s growth. Contact us today for more information! (877) 670-1590

Author: Courtney Rosenfeld

If you’ve heard mentions of a possible recession in the news, you might have the impression that it’s an impending doomsday event. Indeed, recessions are often treated as a catastrophe, but you shouldn’t fall prey to this idea. A recession simply means that the economy is declining, and although this isn’t good, it doesn’t have to wreak havoc on your life. Consider the following reasons you can still thrive in spite of the economy.

You may not have control over the economy, but that doesn’t mean you’ve lost control over your own financial future. You can still find a way to thrive by establishing a practical budget and sticking to it. Managing a budget can be difficult in a recession, though, as prices for goods and services often fluctuate. It’s important to integrate these variables into your budget and account for the fact that some expenses may vary.

When you do need to spend money, you should do so with a clear intention. If you’re shopping for pet food, for example, consider what your priorities are as you shop. Are you looking for the greatest quantity for the lowest price — or are you seeking a product that costs more and offers better quality? Read reviews to ensure your purchases are worthwhile.

Some homeowners fear a recession because they face the possibility of an upside-down mortgage. Although this certainly isn’t a positive outcome, you do still have options for handling the situation. You can sell your home through a short sale, for example, to avoid damaging your credit. If you choose this route, you may be able to get your insurer or lender’s approval as soon as you receive an offer from a buyer.

According to experts, one of the main symptoms of a recession is a decline in the stock market. As the economy lulls, many companies will see decreased valuation, which can be disheartening for anybody with investments. If you are looking for a way to diversify your portfolio, though, a recession is a great time to do so. Stocks are often more affordable, allowing you to snatch them up at bargain prices.

One of the greatest issues in a recession is the general stress that families face. If your finances do indeed take a hit, you can adapt by finding new sources of income. The easiest way to do this is to pick up a side gig. Earning extra income on the side can give your budget more of a buffer, which in turn, can alleviate the stress that often accompanies a recession. The additional income may even help you gain a financial advantage and come out of the recession stronger than ever.

Learn How to Thrive Despite Economic Decline

The economy affects everybody, but that doesn’t mean you have to suffer. Even when stocks are falling and prices are rising, you and your family can thrive — and if you’re faced with an unfavorable mortgage, selling your home may offer a solution. A recession is an opportunity to build resilience.

Author: Courtney Rosenfeld

Running a business requires a lot of hard work, dedication, and sacrifice, so it can be particularly frustrating when your business is under threat from a force beyond your control. Inflation can cause significant losses to your business’s profit margins and cause you to lose customers or clients due to increased prices. You can mitigate some of the damage caused by inflation, but it will require financial planning, management skills, and accounting tools. Today, Rock Capital and Associates addresses some actions you can take in this troubling economic time.

Although inflation can be a complex circumstance, you can stave off the immediate issues it causes by changing prices. Charging more for your goods or services is the simplest way to absorb increases in operating costs caused by inflation. However, this can drive away customers who either can’t or aren’t willing to pay more. If you believe inflation will be short-lived, you can cushion your business operations with some of your cash reserves, but don’t do this for too long. If you don’t have the capital you need to weather the storm, consider applying for a business loan that can provide the gap financing you need.

Addressing inflation as a business owner requires you to have in-depth knowledge of how economic trends affect your business’s profits and expenses. If you don’t already own accounting software, it’s a good idea to purchase one you can use to track monthly expenditures and income and the changes in those trends. Software also makes it much easier to find accounting errors, payroll errors, and other issues that lose you money over time and hurt employee morale.

Additionally, you need to keep a close eye on your own credit report – especially if you anticipate requesting a loan at some point. Remember that there are things you can do to improve your credit, like paying off debts. Even checking your report can give you a small bump in your score, which could help a lot down the road should inflation ramp up and you find yourself needing a business loan.

Another way to address the threat of loss caused by inflation is by amping up your business’s productivity. If you have particularly skilled, fast, or helpful employees, it might be time to offer them a slight raise and find ways to boost their morale. This will help them become more efficient and productive. You can also invest in technologies that automate one or more of your business processes to save on labor costs.

In a time of serious inflation, it may be difficult to retain all your customers since you may have to raise prices. However, investing in marketing can attract more customers and help to mitigate the loss of business. You don’t necessarily have to spend a lot of money on marketing, either. It’s easy to use an online background removal tool to cut out photos of your products or services, edit them, and place them on new excitingbackgrounds and ads. Running online promotional campaignscan also be a good idea.

Inflation can wreak havoc on small business owners and make it seem impossible to keep going. With efficient financial management, preparation, and the right tools, you can prevent inflation from costing you your business.

Rock Capital and Associates will help you determine the best financial route for your company’s growth. Call 877-670-1590.

Image via Pexels

Author: Courtney Rosenfeld

If you are a senior considering a business startup, you’re in good company. According to the Small Business Administration, business owners 55 and older account for 51% of employers and 35% of businesses without employees. Senior entrepreneurs are statistically more likely to thrive. According to a study co-authored by professionals from Wharton, Northwestern, MIT and the SBA, 50-plus-year-old founders are 1.8 times more likely to succeed than those in their 30s.

Naturally, as you start your company, you’ll need to think about marketing. Advertising, the most obvious component of a marketing plan, lets others know about your products or services. Today’s advertising strategies, though, are more complex than even a decade ago. To give you an idea of what to expect, here are some tips and resources, courtesy of Rock Capital and Associates.

Understand How Technology Shapes Advertising

Technology and social media have changed the way consumers shop. Online shopping is now one of the most prevalent internet activities around the globe. Social media affects product awareness in several ways:

Harnessing the power of technology is not only a smart move for today’s business owner, but it also could mean the difference between struggling and thriving. Fortunately, using technology to advertise may be easier than you think.

If you’re new to most concepts related to IT and technology, it may be worthwhile to take online courses to boost your knowledge. While running a business and going back to school may seem incompatible, online learning opportunities allow students to work at their own pace.

Use Cross-Promotion

With this advertising method, you pair with a non-competing business to promote services or products. If you open a coffee shop downtown, for example, and there’s a candy store next door, your businesses can partner. Your products do not compete with each other, and they could work well together in an advertising campaign.

What would a cross-promotional ad campaign look like? You can link to each other’s businesses on your websites. Say, for example, you add a link that says, “Are you looking for something delicious to enjoy with our coffee? Visit XYZ’s candy shop and try the new chocolate truffles.” You can also post coupons or discount codes for each other’s products on social media.

Cross-promotion works best when you know the shopping habits and characteristics of your most profitable customers, and both companies can efficiently promote each other’s products. Sharing similar customer segments with your partner results in the most effective marketing campaigns.

Maximize Inexpensive Resources

Traditional advertising channels, such as radio, television, and newspaper ads, are still effective. The downside is their costs. If your advertising budget doesn’t allow for them, consider free or inexpensive ways to advertise online.

Search engine optimization helps you get noticed in an online search. Easy ways to increase SEO can yield good results:

Setting up a business profile on social media accounts increases your visibility, answers customer questions, and attracts attention. Your business social media accounts should be separate from your personal ones. You can also pay to boost your most popular posts. This is a relatively inexpensive and powerful way to target your audience and get your posts in front of consumers most likely to buy your product. Last but not least, you can use this invoice maker free of charge to maintain a professional connection with your customers while maintaining precise records.

Whether you’ve retired or just want a career change, starting a business as a senior entrepreneur can be a rewarding and lucrative move. Harnessing the power of technology helps potential customers find your company at a fraction of the cost of traditional advertising and lets you pour more resources into your business.

Rock Capital and Associates will help you determine the best financial route for your company’s growth. Additionally, once a lender is pre-determined per your financial requirements, your RCA will help you package the transaction in accordance with the Lender’s requirements, so your loan is funded in the fastest and the most efficient manner possible. Call 877-670-1590.

Article Content by: Courtney Rosenfeld

Is your small business swimming in seemingly bottomless debt? If so, you’re not alone.

According to data from the Small Businesses Voices survey conducted by Goldman Sachs, 40% of small businesses in the United States “have less than three months of cash reserves.” Also, about 31% of business owners felt they could find funding to shore up their businesses, but only 20% of Black business owners felt like they could find financing.

However, you don’t have to remain in debt. You can take further action via the following steps, presented below by Rock Capital & Associates.

Rock Capital & Associates has hundreds of programs available for their clients. By having access to a Business Finance Consultant, you have access to hundreds of funding sources across the United States and Canada. Visit our website or call us at 1-877-670-1590.

You probably already know the importance of keeping a budget for your business. However, it’s also probably been a while before you gave it a second look. The first thing you want to do is take an audit of your entire budget by going through all of your financial transactions, bank statements, expenses, and sources of income from the past year. These things will tell you where you’re possibly wasting money and where you need to make improvements.

You’ll also want to get your bookkeeping up to date by using intuitive financial tools. There are apps and software that can help you generate budget reports in real-time based on your current balance statements and tailor-fit them to your needs. This, in turn, allows for more efficient forecasting so you make better spending decisions while monitoring your overall expenses.

Making more money is a critical step in getting out of debt. The more money your business can make, the better chance you have at paying off your loans and credit lines quicker. There are tons of ways to boost your sales and garner new customers. Figure out which methods will work best for your business and get to work.

Consider the journey your customer goes on to reach that final sale, often called a conversion funnel. How can you help your clients solve a problem they are having, and how can you easily lead them to the solution (your product or service) that they are willing to pay for?

Your budget should give you a general idea of which recurring expenses are a waste of your time. For example, maybe some certain products or services aren’t popular, or maybe you’re not getting the most out of current subscriptions. You may also want to consider relocating to a more affordable space or even a shared workspace — your expense-cutting options are virtually limitless. You just have to zero in on what your business can absolutely live without.

There are apps and tools, some even free, that exist to help you save money at little to no cost on things you might otherwise be spending tons of money on. For example, Time Doctor will keep track of hours used in work for business productivity and tax purposes. Google Workspace provides a way for all your team to work using similar tools like Docs and Sheets with storage space up to 30 gb. Survey Monkey allows you to create surveys to monitor what your clients need and build services and/or products around customers. Marketing-wise, you can start out with a free logo design. It’s ideal for a new product launch or to rebrand, and can carry across multiple platforms. That way, you won’t necessarily have to spend money on a designer.

In addition to reducing and restructuring your expenses, it’s a great idea to reach out to any vendors you’re working with to see if you can negotiate the terms and pricing of your contracts. It’s very common to get comfortable with your vendors, allowing them to take advantage of you by raising their prices and neglecting to improve their offerings. Here is where you can figure out who is worth continuing a relationship with and where you can minimize supplier expenses.

By using the following suggestions, you and your small business can start to make the journey out of debt instead of drowning in debt. Instead of making this voyage from financial uncertainty toward financial stability alone, why not reach out to Rock Capital & Associates to see how we can help you!

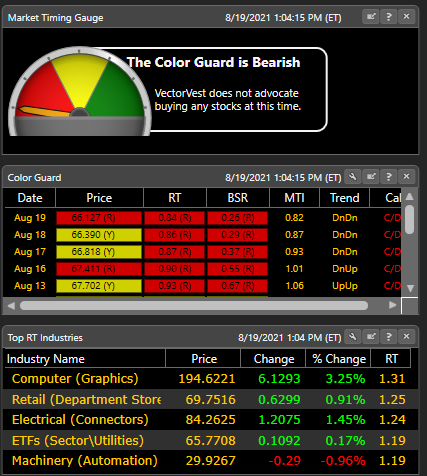

The VectorVest Colorguard is Bearish this afternoon driven by continued concerns the COVID Delta variant, turbulence in Afghanistan and China plus rising prices. In addition, the FED released the minutes to Wednesday’s meeting which pointed to the possibility that the central bank may start tapering its pandemic-related monetary stimulus this year.

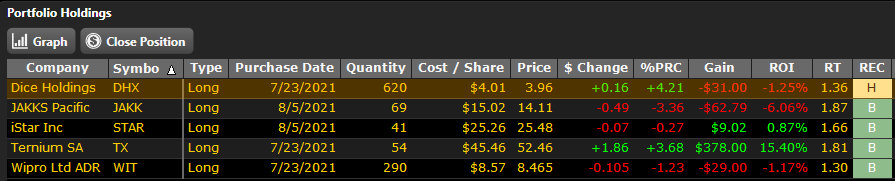

It’s not recommended to buy stocks at this time and I would suggest reviewing your portfolio for loss leaders and evaluate whether to pare down those positions to provide cash for future trades. I just closed out positions in BTU, TGH and TX due to heavy moves downward!

Stock futures were down this morning on the news and some indices have rebounded this afternoon. That said, here’s where the market stands at 1:20pm EST:

| Market Sentiment |

| RoboTrader Portfolio as of 8/19/21 |

Here are my RoboTrader Portfolio holdings as of this afternoon. To note, all trades were automatically placed on a paper trading account as of 1:20PM EST today.

Short-term indicators have turned from Neutral to Bearish and all of the positions were opened on Tuesday as shorts and all but 2 of the trades are winning.

| IBKR Portfolio Stock Spotlight Stock Spotlight |

Given performance over the past couple of days, I’ve had to close out some of my Interactive Brokers positions. TX and BTU and both made strong moves down today which served to push the positions up against the STOP loss of 7%. I’ll be using the cash to prepare for the following scenarios:

| STASH INVESTING – FREE STOCK OPPORTUNITY |

My aunt started using STASH last summer to save, bank and invest. After seeing how it worked I decided to try it out myself. Since then, I’ve seen some amazing investment gains and have grown to love using the STASH Card and earning stock back from purchases.

Up 196% since August 2020

$821 saved by Rounding Up and making auto transfers

This past Wednesday night I claimed my FREE Bed, Bath & Beyond ($BBBY) stock and I couldn’t be more happy to stack my pennies. Every Wednesday night at 8PM and sometimes on Fridays and Sundays STASH has additional giveaways. If you’re not signed with STASH, now might be the best time to take control of your saving and investing. Click here to signup!

PARTY STARTS EVERY WEDNESDAY AT 8PM! GET STASH NOW!

| CRYPTO Corner |

I’ve been using Coinbase for the past 3 years and find it super easy to use for buying, moving and earning Crypto! Wish I had bought much more Bitcoin back then! When you spend $100 both you and I get $10 in Bitcoin. Let’s get it started! Get Started On Coinbase!

| Research Materials |

ARK Investments has provided a detailed investment report for 2021 and beyond. It covers what’s anticipated for the following:

| Must Read! Reddit Profit Taking Article |

| Need Money For Your Business? |

My LLC and Brand Name which covers Digital Marketing & Analytics Consulting

This is a marketing message from Rock Digital, LLC as sent from [email protected]. Please reply to sender with any questions or to opt-out from this newsletter.

Rock Digital LLC © All rights reserved Ph: 877-670-1590 | [email protected] | www.rockcapassoc.com

Article Content By: Courtney Rosenfeld

If you’re thinking of starting a side hustle, you aren’t alone. Zapier reports that one in three Americans has a side gig as a means of making some extra money alongside another job. While it’s great to get some extra cash, juggling your side hustle along with your other obligations can be tricky.

If you’re starting a freelance business as a side hustle, get organized from the beginning to save yourself administrative burden later. Establishing a limited liability company, LLC, can simplify paperwork like tax filing. Make sure to get an Employer Identification Number, EIN, which the IRS will need to identify your business for payroll taxes.

Setting up your business as a formal entity like an LLC can save time and stress later. You can also spare yourself worries by getting a handle on your finances. Rock Capital provides business and commercial financing so you have one less thing to worry about as you get your side hustle off the ground. They provide financial services that will help your business secure funding for things like working capital, equipment leasing and buying, construction costs and so much more!

Make a healthy diet and exercise part of your regular routine

It can be tempting to put all of your energy into your burgeoning business. However, it’s important to take the time to eat right and exercise regularly. Self offers tips for eating a nutritious diet when you’re short on time. For example, you can batch cook and freeze meals and buy pre-cut and pre-bagged produce.

There are also plenty of time-saving tips that can help you make space in your schedule for physical activity. If you don’t have time for a workout, make a concerted effort to walk as much as possible during the day. For instance, if you take public transport, get off one stop further away than you normally would.

Take time for mental and spiritual self care

Your mental and emotional wellbeing is just as important as your physical fitness. Make efforts to keep the stress that comes with starting a side hustle at bay. Mindfulness is one technique you can use. It not only helps minimize stress, it’s also linked with entrepreneurial success and innovation.

No matter how busy you are, take at least 15 minutes out of every day for self care. During this time, focus on doing something that’s for pure enjoyment and pleasure—not any practical purpose. There are many easy activities you can do in 15 minutes, like savoring your favorite snack, writing in a journal, or reading.

Find ways to unwind after the work day and get a good night’s sleep

A good night’s sleep is an essential component of self care. It is proven to restore your energy, improve levels of motivation, and even support your immune health. Plus, it leaves you refreshed and ready to tackle the challenges of running a side hustle. Make your bedroom into a soothing space that’s conducive to sleep by investing in new sheets, getting blackout curtains, and turning on a white noise machine.

You can also help improve your quality of sleep by practicing good habits before bed. For example, try to set a strict sleep schedule, getting up and going to bed at the same time daily. Avoid using blue-light-emitting devices before bed and steer clear of caffeine and alcohol, which can disrupt sleep patterns. I recently came across the Oura Ring which is wearable technology that helps to manage sleep patterns in a fun and smart way. Check out this article on www.workoutcave.com for 10-tips to better sleep.

Juggling your side hustle and self care doesn’t have to be impossible. Use the above tips to strike the right balance.

For more content to help you thrive in business, check out Rock Capital. We help entrepreneurs find success through financial guidance. Find out more.

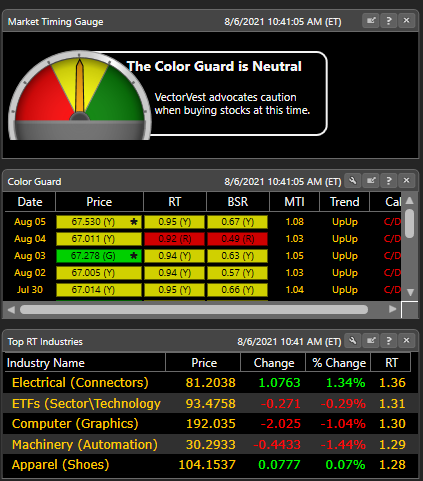

The VectorVest Colorguard is Neutral this morning after this morning’s Jobs report which showed strong gains in wages and employment. The unemployment rate ticked down to 5.4% from last month’s 5.9% and an expected rate of 5.6%.

Although job gains came in better than expected, the new Delta Variant of COVID is raising cause for concern as hot spots begin to crop up and many are still afraid of being vaccinated. This is causing mixed results today in the market, which as of 11:25AM stands here:

| Market Sentiment |

| RoboTrader Portfolio as of 8/06/21 |

Here are my RoboTrader Portfolio holdings as of this morning. To note, all trades were automatically placed on a paper trading account at 11:10AM EST today.

Short-term indicators remain mostly Neutral which is causing a selloff in some sectors such as Leisure (Toys/Games) which is down more than (-2.0%). And given that the VV call is DOWN, it doesn’t currently bode well for share appreciation.

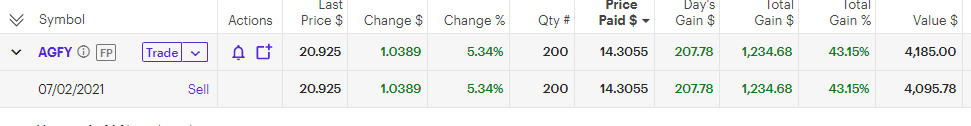

| Etrade Portfolio Stock Spotlight |

AGFY – develops advanced and precision hardware and software grow solutions for the indoor agriculture marketplace. It offers Agrify Precision Elevated cultivation solution that combines integrated hardware and software offerings with a wide range of associated services, such as consulting, engineering and construction. The Company offers its modern solutions to cultivators across various commercial segments including fruits, vegetables, hemp and cannabis. Its business model includes substantial equipment sales for the Agrify Vertical Farming Unites (AVFUs) as well as recurring software-as-a-service (SaaS) revenues for Agrify Insights.

I purchased this high performer about a month ago and it’s done very well. It’s currently Buy rated within VV and is sporting strong technicals and we’ll see how fundamentals are developing next Thursday as an earnings call is scheduled. Buy at $21.12.

| STOCK RECOMMEDATIONS |

TX – steel products producer making finished and semi-finished steel products and iron ore, which are sold either directly to steel manufacturers, steel processors or end users. The Company operates through two segments: Steel and Mining. The Steel segment includes the sales of steel products and the Mining segment includes the sales of iron ore products, which are primarily inter-company. The Steel segment comprises three operating segments: Mexico, the Southern Region and Other Markets. In the steel segment, steel products include slabs, billets and round bars (steel in its basic, semi-finished state), hot-rolled coils and sheets, bars and stirrups, wire rods, cold-rolled coils and sheets, tin plate, hot dipped galvanized and electrogalvanized sheets and pre-painted sheets, steel pipes and tubular products, beams, roll-formed products, and other products. In the mining segment, iron ore is sold as concentrates (fines) and pellets.

I recently purchased this in my E*Trade portfolio and it’s up 5% now VectorVest is sending Buy signals. Strong Technicals and improving Fundamentals, buy at $52.13.

| STASH INVESTING – FREE STOCK OPPORTUNITY |

My aunt started using STASH last summer to save, bank and invest. After seeing how it worked I decided to try it out myself. Since then, I’ve seen some amazing investment gains and have grown to love using the STASH Card and earning stock back from purchases.

Up 196% since August 2020

$821 saved by Rounding Up and making auto transfers

Yesterday I earned a small amount of educational stock Chegg (CHGG) to go along with 7 other freebies over the past month. Next Wednesday night at 8PM STASH is giving away more FREE Stock so stay tuned! If you’re not signed with STASH, now might be the best time to take control of your saving and investing. Click here to signup!

PARTY STARTS EVERY WEDNESDAY AT 8PM! GET STASH NOW!

| CRYPTO Corner |

I’ve been using Coinbase for the past 3 years and find it super easy to use for buying, moving and earning Crypto! Wish I had bought much more Bitcoin back then! When you spend $100 both you and I get $10 in Bitcoin. Let’s get it started! Get Started On Coinbase!

| Research Materials |

ARK Investments has provided a detailed investment report for 2021 and beyond. It covers what’s anticipated for the following:

| Must Read! Reddit Profit Taking Article |

| Need Money For Your Business? |

My LLC and Brand Name which covers Digital Marketing & Analytics Consulting

This is a marketing message from Rock Digital, LLC as sent from [email protected]. Please reply to sender with any questions or to opt-out from this newsletter.

Rock Digital LLC © All rights reserved Ph: 877-670-1590 | [email protected] | www.rockcapassoc.com

2017 Rock Digital, LLC Design & Developed by Buy Wordpress Templates